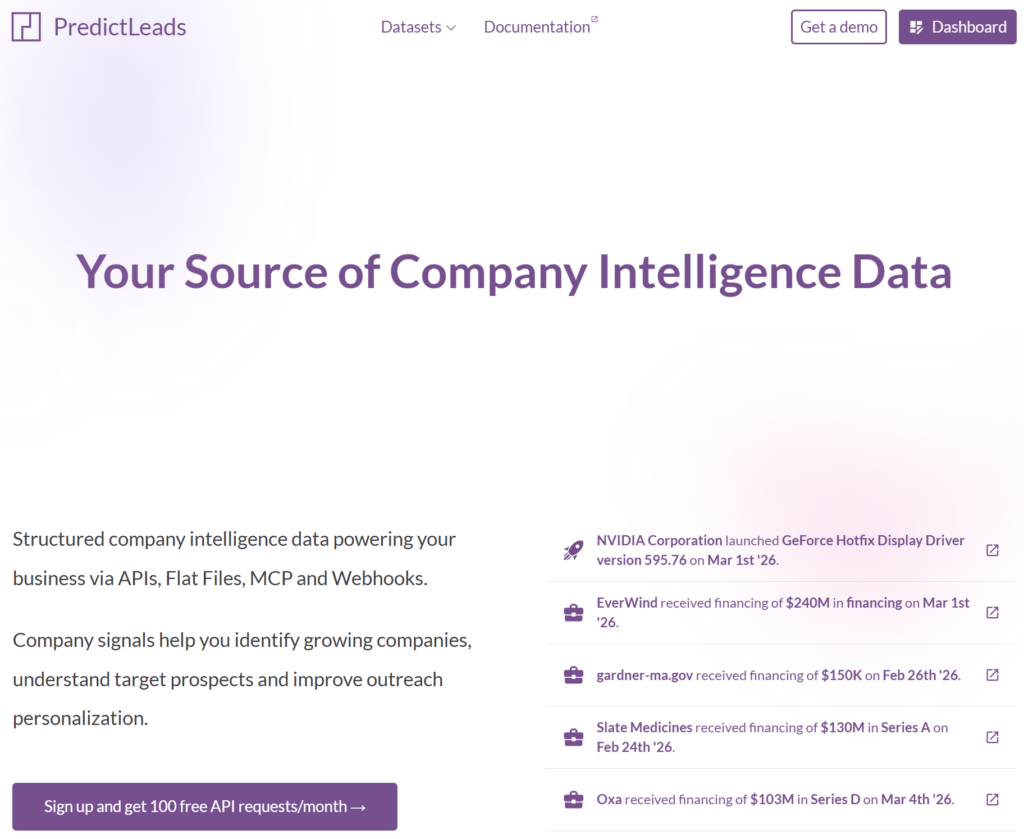

PredictLeads partners with Orthogonal to expand its services, and PredictLeads is now available through Orthogonal, a platform that provides trusted APIs and skills for AI agents.

This integration allows AI agents to access structured company intelligence signals from PredictLeads without building custom integrations or managing multiple API keys.

Developers can now retrieve company signals such as:

- Hiring activity

- Technology adoption

- Company news events

- Funding activity

- Business connections

These signals can be used inside automated workflows for sales research, investment analysis, competitive monitoring, and market discovery.

What Orthogonal Provides

Orthogonal is an API layer designed for AI agents.

Instead of integrating multiple APIs individually, developers connect once to Orthogonal and gain access to a catalog of verified APIs.

Agents can:

- Search for APIs using natural language

- Retrieve endpoint documentation

- Generate integration code

- Execute API calls directly

PredictLeads is now part of this ecosystem, allowing agents to retrieve company intelligence data through the Orthogonal interface.

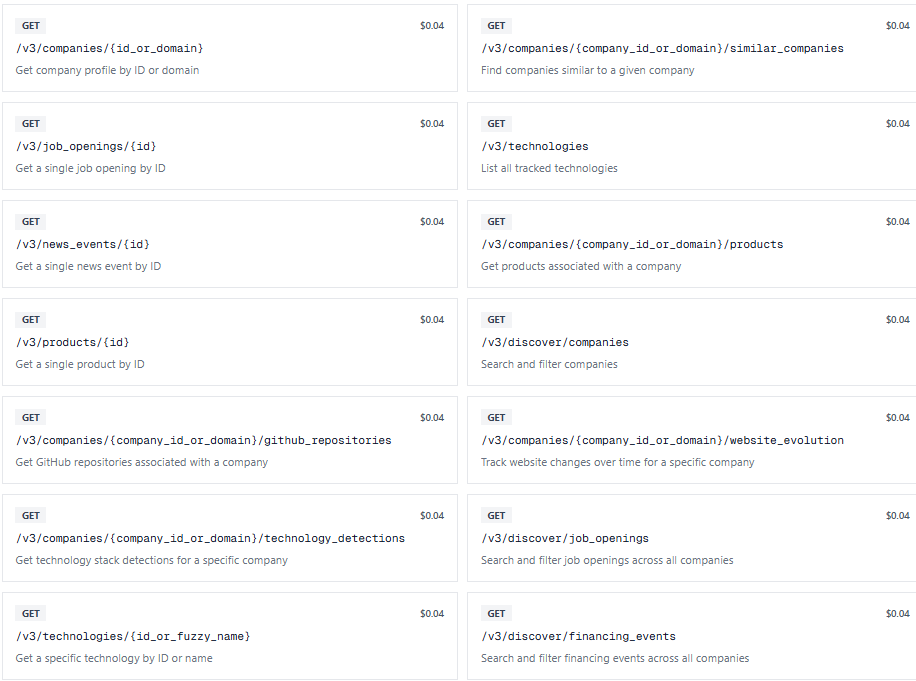

PredictLeads Datasets Available Through Orthogonal

The integration provides access to several PredictLeads datasets that track company activity.

Job Openings Dataset

Endpoint:

/v3/companies/{domain}/job_openings

This dataset tracks hiring activity across companies.

Signals include:

- New engineering roles

- Sales hiring expansion

- Hiring in new regions

- Growth in open positions

Hiring data often indicates company expansion or new initiatives.

News Events Dataset

Endpoint:

/v3/companies/{domain}/news_events

This dataset tracks structured company announcements such as:

- Product launches

- Partnerships

- Market expansions

- acquisitions

News events provide real-time insight into company strategy and activity.

Technology Detections Dataset

Endpoint:

/v3/companies/{domain}/technology_detections

This dataset identifies technologies used by companies.

Examples include:

- cloud infrastructure

- marketing automation tools

- analytics platforms

- developer tools

Technology adoption signals help understand a company’s technical environment and vendor stack.

Financing Events Dataset

Endpoint:

/v3/companies/{domain}/financing_events

This dataset tracks company funding activity including:

- Seed rounds

- Venture funding

- Growth capital

- Strategic investments

Funding events often signal expansion and new investment capacity.

Connections Dataset

Endpoint:

/v3/companies/{domain}/connections

The connections dataset tracks relationships between companies, including:

- Investors

- Integrations

- Partnerships

This helps map a company’s ecosystem and strategic relationships.

Example AI Workflow Using PredictLeads

An AI agent researching potential prospects could run the following workflow:

- Retrieve company profile

- Check hiring activity

- Detect technology stack

- Retrieve recent news events

- Check funding history

Example output:

Company: example.com

Signals detected:

- Raised Series B funding

- Hiring software engineers

- Adopted Snowflake

- Announced new partnership

The agent can then generate a company intelligence summary or prioritize the company as a sales prospect.

Why This Integration Matters

AI agents require structured company signals to analyze markets and companies effectively.

PredictLeads provides these signals through datasets that track:

By integrating with Orthogonal, these datasets become directly accessible to AI agents without additional integration work.

Developers can use PredictLeads data inside agent workflows for:

- sales prospecting

- competitive monitoring

- investment research

- account intelligence

- market discovery

PredictLeads as the Intelligence Layer for AI Workflows

PredictLeads tracks structured signals across millions of companies.

Through the Orthogonal integration, these signals can now be accessed directly by AI agents.

This allows developers to build systems that automatically detect company activity and generate insights based on real-time business signals.

PredictLeads becomes the company intelligence layer powering AI-driven research and decision workflows.