“Find more companies like our best customers” sounds easy. Then you open your prospecting tool, filter by industry + headcount + revenue, and end up with a list that looks big but feels dead. Instead, you need to focus on lookalike companies actively hiring and recently funded. Some of those companies might be a fit on paper, but they’re not changing anything, not buying anything, and not feeling any pressure to act now.

The better approach is to pair similarity with growth signals. When you focus on companies that look like your top accounts and are hiring and just raised money, you stop guessing and start targeting teams that are actually building.

Below is a practical workflow you can run over and over. Whether you’re doing outbound, ABM, partnerships, or building lists for your SDR team.

Why static ICP filters don’t scale (and don’t catch momentum)

Most go-to-market teams start with a sensible ICP: industry, company size, geography, maybe tech stack. That’s a good baseline but the problem is those inputs are mostly static, and buying is not.

Traditional filters are backward-looking

Revenue bands and headcount categories tell you what a company has—not what it’s trying to do next.

A company can still show up as “50–100 employees” in a lot of datasets while it’s in the middle of hiring 40 people, opening a new office, and rebuilding its go-to-market motion. That’s exactly the kind of account that buys tools, but it’s easy to miss if you only use firmographics.

“Lookalike” lists get messy fast

Even when you know your best customers, it’s hard to find similar companies at scale without falling back on shallow comparisons. That’s how lists get bloated and outreach starts to feel generic.

Same size doesn’t mean same priorities

Two companies can share the same headcount and revenue and be in totally different modes:

- One is freezing hiring and cutting spend.

- The other is hiring aggressively, rolling out new systems, and expanding into new markets.

If you don’t layer in signals, you can’t tell which is which—and your reps will find out the hard way.

Why hiring and funding are two of the best signals for outbound

Growth creates problems that need solving. Hiring and funding are two signals that show a company is moving, not sitting still.

Hiring tells you where the company is investing

Job postings are one of the most useful “open tabs” on a company’s priorities. They tell you what teams are being built and what capabilities are missing.

A few common patterns:

- Sales hiring (AEs, SDRs, sales leadership): pushing for revenue growth, new segments, or new geos.

- RevOps / Ops hiring: tooling, process, measurement, and cleanup projects are coming.

- Data engineering / analytics hiring: centralizing data, building pipelines, rolling out BI, getting serious about attribution.

- Security / compliance hiring: maturing infrastructure, preparing for bigger customers, tightening controls.

Volume matters, but context matters more. Ten open roles in engineering doesn’t help you if you sell into finance. Hiring by department gets you closer to a real buying story.

Funding is a budget and timeline signal (not a guarantee)

Funding doesn’t automatically mean “ready to buy,” but it often means a company has the runway to invest. After a raise, teams tend to accelerate hiring, expand into new markets, and upgrade systems that were “good enough” before.

Funding stage also helps you match your motion:

- Seed / Series A: smaller teams, faster decisions, tighter tooling needs.

- Series B / C: scaling teams, more stakeholders, more process, more integration work.

- Later stage: more procurement, stronger requirements, longer cycles (but bigger deals).

Similarity + hiring + funding is where the list gets interesting

Similarity finds the “right shape” of company. Hiring and funding tell you whether they’re in a phase where change is already happening. Put together, you get segments that are both relevant and timely.

A repeatable workflow to find lookalike companies with urgency

This is the same structure you can use whether you’re building a quarterly target account list or refreshing priorities every week.

1) Start with your best customers (not your biggest)

Pick a set of accounts that represent “ideal” in practice. Often that’s not your largest logos—it’s the customers with strong retention, short ramp time, and clear product value.

Look at:

- Retention and expansion

- Sales cycle length

- Time-to-value and product adoption

- Who bought and why (use case)

If you can, add context like their funding stage at the time they bought, the teams they were hiring for, and the tools they already had in place.

2) Generate a similarity list using more than firmographics

A useful lookalike model doesn’t stop at “same industry and size.” The best results come from combining multiple signals, for example:

- Industry and sub-industry

- Business model

- Tech stack

- Growth patterns over time

- Hiring behavior

From there, pull a “top N” set of similar companies per best-customer account, then merge and dedupe into a master list.

3) Filter for companies that are hiring right now

Reduce noise by cutting the list down to companies with active job openings. This is a simple move, but it changes the feel of the list immediately: fewer “maybe someday” accounts, more teams in motion.

4) Narrow by department, role, and seniority

Now make the hiring signal usable for targeting:

- Focus on departments tied to your solution

- Prioritize roles that influence buying (leadership, ops, owners of systems)

- Track hiring pace over the last 30–90 days

A company with steady hiring is interesting. A company whose hiring is accelerating usually has deadlines.

5) Overlay recent financing events

Add a window for funding recency (for example, last 6–12 months), and segment by stage so you can tailor messaging and qualification.

Funding should sharpen your list, not replace fit. If you only chase “recently funded,” you’ll still waste time on companies that aren’t a match.

6) Sanity-check momentum with company events

Before handing accounts to reps, validate that the growth story is real. Useful signals include:

- Expansion announcements (new locations, new geos)

- Product launches

- New leadership hires

- Major website changes (often tied to positioning or new markets)

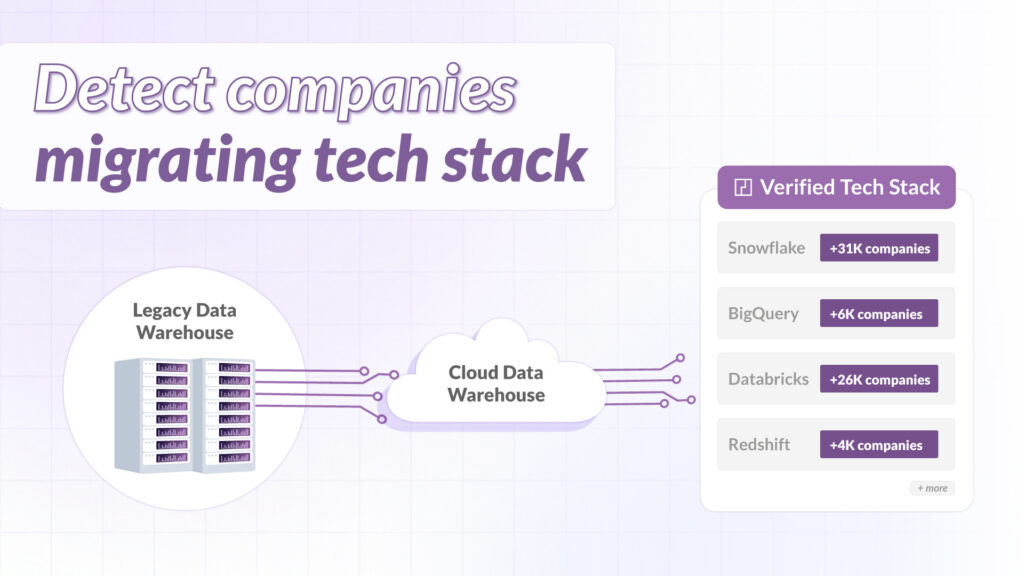

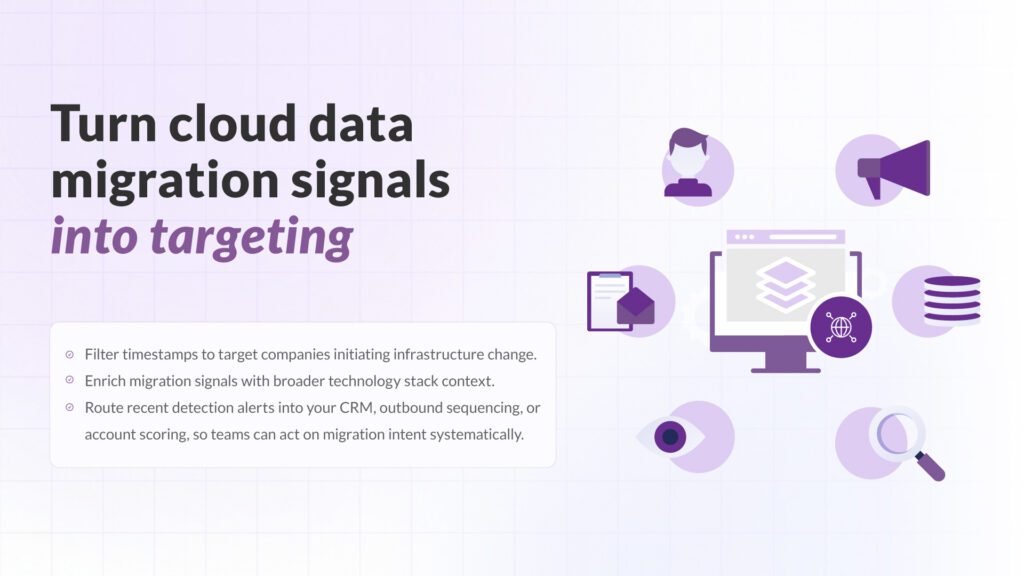

7) Check tech stack fit (and watch for new adoption)

Tech alignment is an easy win. If your best customers tend to run on certain tools, prioritize lookalikes that share or complement that setup.

Also pay attention to recent tech adoption. If a company is actively rolling out new systems, they’re usually more open to evaluating and buying.

8) Use shared connections to prioritize warm paths

Shared investors, partners, and customers can change cold outreach into a warm intro—or at least give your messaging a credible hook.

If you see the same VC backing multiple customers, that’s often a pattern worth leaning into.

9) Build tiers your team can actually work

Don’t ship a 5,000-account list to Sales and hope for the best. Score and tier accounts so reps know where to start.

A simple scoring model can include:

- Similarity score

- Hiring intensity and hiring speed

- Funding recency and stage

- Tech fit

- Shared connections

10) Push it into your CRM and keep it fresh

Signals expire. The whole system works better if you refresh it automatically, so reps aren’t working accounts that stopped hiring three months ago.

Send your tiers into the CRM (or sales engagement tool), and set a cadence for updates so the list stays relevant.

Where PredictLeads fits in

This workflow is only as good as the data behind it. PredictLeads is built for teams that want to do signal-based targeting without stitching together five different sources.

- Similar Companies: find lookalikes based on multiple attributes, not just company size and industry.

- Job Openings: filter by active roles, department, and hiring momentum.

- Financing Events: track funding rounds, dates, amounts, and stage.

- News Events: pick up structured company events like expansions and launches.

- Technology Detections: segment by installed tools and recent adoption.

- Connections: see investors, partners, and other relationships you can use to prioritize accounts.

If you’re interested in learning more about our data, do feel free to reach out! We are here to help.