In today’s highly competitive market, leveraging investor networks for business growth can be a key strategy for companies offering innovative solutions that often face significant challenges in scaling their businesses. Despite having a great product or service, many companies struggle to:

- Break into new markets: Identifying and engaging with potential customers in new sectors or geographies can be daunting.

- Build trust quickly: Establishing credibility with prospects, especially in B2B markets, can take considerable time and effort.

- Stand out among competitors: Differentiating from competitors in crowded markets is increasingly difficult.

- Access the right networks: Many companies lack the connections necessary to open doors to high-value prospects or strategic partners.

These challenges can slow down growth and make it harder for companies to reach their full potential, even when they have strong products and a clear value proposition.

How Investors Can Step In: Leveraging Investment Networks

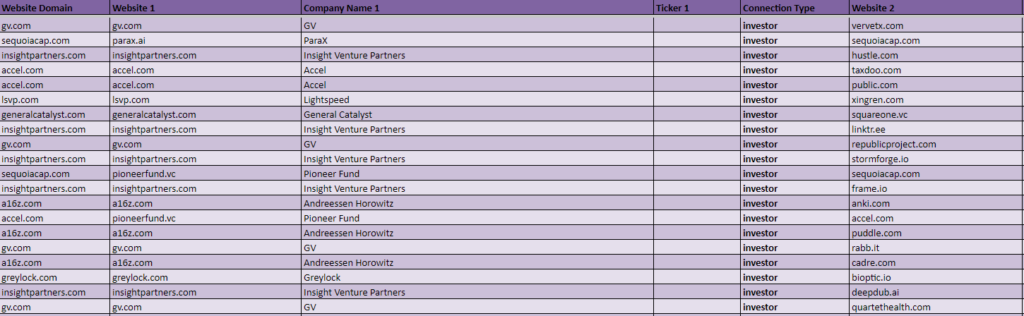

This is where your investors can play a pivotal role. Many venture capital firms, such as Sequoia Capital, Andreessen, and Insight Partners, have extensive networks that go beyond mere financial backing. These investors have invested in a diverse portfolio of companies, creating a network of businesses that can be leveraged to accelerate your growth. Here’s how:

Leveraging Investor Introductions

Your investors can facilitate introductions to other companies within their portfolio. These introductions can be invaluable, providing you with direct access to potential customers, partners, or even key industry influencers.

- Example: If your company is backed by Sequoia Capital, they can introduce you to other companies in their portfolio that could benefit from your product. This not only opens the door to new business opportunities but also provides a trusted endorsement that can significantly shorten the sales cycle.

Proactive Outreach Using Shared Investment as a Connection Point

Rather than relying solely on investor introductions, you can take a proactive approach. While a shared investor relationship helps establish credibility, it’s important to highlight why your outreach makes sense for the recipient. A tailored message that emphasizes a logical fit between your offering and their current needs will go much further.

- Example: If GV (formerly Google Ventures) has invested in both your company and Verve Therapeutics, you could reach out to Verve Therapeutics with a message like:

“Hi Mike,Saw we’re both fellow GV portfolio companies and that you’re hiring heavily for your Marketing department. We provide [x marketing software], and thought we should chat to see if we can support your efforts.”

The focus here isn’t just on the shared investor, but on how your product could address their specific needs – in this case, scaling their marketing team. This not only builds instant credibility but also offers a clear, relevant reason for them to engage in a conversation.

Additional Use Cases: Uncovering Broader Business Relationships

The value of your investor’s network extends beyond just portfolio companies. The dataset also uncovers other crucial business relationships such as partners, vendors, sponsors, and more. These connections can be leveraged in various ways:

- Identifying Strategic Partners: Discover companies that share common partners with your business, opening up possibilities for joint ventures, collaborations, or technology integrations.

- Vendor Optimization: Uncover potential vendors within your investor’s portfolio or those of their partners, enabling you to streamline your supply chain or access better resources.

- Sponsorship Opportunities: If your investor has connections with companies that are looking for sponsorship opportunities, this data can help you identify potential sponsors who align with your brand.

Mentioned Companies

The investment companies and some of their notable recent investments include:

- GV (formerly Google Ventures): Wealth, Bounti, Cribl

- Sequoia Capital: Captions , Harmonic , Magic

- Insight Partners: Command Zero , Sysdyne Technologies , Afresh

- Accel: Zepz , VoidZero , VSCO

- Andreessen Horowitz (a16z): Alchemy , Azra Games , Talos

- Index Ventures: Tebi , Valdera , Jump

- And more!

Conclusion: The Power of Strategic Network Utilization

By strategically utilizing the investment network data, your company can overcome the common challenges of breaking into new markets, building trust, and accessing the right networks. Whether through facilitated introductions by your investors or proactive outreach, the shared investment relationship serves as a powerful tool for building trust and opening doors. Additionally, by exploring connections such as partners, vendors, and sponsors, you can further optimize your business operations and discover new growth opportunities.

Would you be interested in utilizing this data in platforms to supercharge your sales outreach and lead generation strategies? You can find the full report and more details here.