Competitor hiring is one of the cleanest early signals you can get. Monitoring competitor hiring spikes can help you notice patterns even sooner. Long before a company announces a new product, expands into a new region, or goes after a new segment, they usually start hiring for it.

The catch: job posts on their own don’t tell you much. If you just eyeball a careers page, you’ll miss the pattern. And if you pull a big dump of listings without structure, it’s easy to confuse normal recruiting noise with a real strategic move.

This guide walks through a practical way to detect hiring spikes early using structured job data, then turn those spikes into something your strategy, sales, and RevOps teams can actually use.

Why hiring spikes are harder to spot than they look

Manual tracking breaks as soon as you have real coverage

If you follow one or two competitors, checking LinkedIn and a couple of careers pages can work. The moment you track 50–500 companies, it falls apart.

- You won’t check every company at the same cadence

- You don’t get a consistent historical view (what’s “normal” for them?)

- You can’t easily split hiring by function, seniority, or location

- You’ll miss spikes that appear and disappear within days

Competitive intel needs repeatable coverage, not occasional screenshots.

“They’re hiring” isn’t the point

Most companies always have open roles. The useful question is: are they hiring more than usual, and if so, where?

A jump from 15 to 25 open roles might be a big deal—or it might be business as usual if they typically sit at 20–30 roles every month. Without a baseline, you can’t tell.

If you notice late, you’re reacting to a press release

By the time a competitor publicly announces a launch or expansion, the work has already started. Hiring spikes often show up weeks or months earlier. Catching them early gives you time to:

- tighten positioning before deals start shifting

- prep AEs and CSMs to defend accounts

- adjust territory and vertical plans

- prioritize outreach while they’re building teams and choosing vendors

What hiring spikes actually tell you

Velocity beats raw counts

A company with 200 open roles can be stable. A company that goes from 10 to 35 in a month is changing something. That’s why the rate of change (velocity) usually matters more than the absolute number of postings.

Sustained increases often point to things like:

- new product or major roadmap push

- new market or region entry

- scaling an existing motion because demand is there

- internal transformation (platform rebuild, AI initiative, security overhaul)

Function-level spikes show where the strategy is moving

Total hiring can look flat while one team quietly doubles. Breaking roles down by department is where the signal gets sharp.

- Engineering/product spike: build phase, new platform work, infrastructure spend, AI/ML investments

- Sales spike: new territories, new verticals, higher revenue targets, channel buildout

- Marketing spike: demand gen ramp, category creation, repositioning

- Legal/compliance spike: enterprise readiness, regulated markets, new geographies

- Support/CS/ops spike: customer growth, retention focus, scaling delivery

Geography changes are often the loudest clue

When postings cluster in a new country or city, it’s rarely accidental. It can mean a local sales push, a new office, a services footprint, or preparation for regulatory requirements.

Senior hires are usually “directional”

Director/VP/C-level openings tend to reflect longer-term bets. A “Head of AI” role is a very different story than three new SDR postings. Watch for leadership roles that imply new org structure or a new line of business.

A workflow that works at scale

1) Pick your competitor universe (and be honest about scope)

Start with the obvious direct competitors, then add:

- adjacent tools that can replace you in a buying decision

- companies moving upmarket or downmarket into your segment

- fast-growing startups that are hiring aggressively in your category

It also helps to segment the list by company size and region. A spike means something different for a 60-person startup than for a 12,000-person enterprise.

2) Build a baseline per company (this is the step most teams skip)

You need a “normal range” before you can call something a spike. At minimum, track weekly or monthly posting volume across 6–12 months.

Then break that baseline down by:

- department/function

- seniority (IC vs manager vs executive)

- location (countries/regions/cities)

This is also where you’ll spot seasonal patterns. Some orgs hire heavily after budgeting cycles; others ramp before big product events.

3) Measure velocity and flag deviations

Once you have baselines, look at changes over time:

- week-over-week and month-over-month change in total postings

- net growth in active roles

- changes by function and by geography

As a rule of thumb, spikes that are both large and sustained are the ones worth routing to teams. A one-week burst can be reposting or a recruiting admin cycle. A 4–8 week ramp is harder to fake.

4) Slice the spike into a story your teams can act on

When a spike triggers, don’t stop at “they’re hiring more.” Answer:

- What roles are driving it? (engineering vs sales vs compliance)

- Where are the roles? (new countries, new hubs, remote-only shift)

- What seniority? (leadership hires vs execution hires)

- Is it aligned to a theme? (AI, security, data, enterprise, healthcare, etc.)

This is how hiring data turns into a usable competitive brief instead of a chart.

5) Confirm with a second signal before you bet on it

Hiring is strong, but it’s even better when it lines up with other changes. Common cross-checks:

- funding events followed by headcount expansion

- website updates (new product pages, new industries, new positioning)

- partnership announcements and ecosystem moves

- news and PR tied to new markets or capabilities

Two or three signals together reduces false alarms and gives you more confidence when you escalate internally.

6) Turn it into alerts, routing, and scoring

If the insight stays in a spreadsheet, it won’t change anything. The goal is to push it into the systems your teams already use.

Examples of alerts that teams tend to respond to:

- 50%+ month-over-month increase in total postings

- 3x increase in engineering roles over baseline

- first-time hiring in a new country

- new VP/C-level opening tied to a strategic theme (AI, international, enterprise)

From there, you can:

- prioritize accounts where a competitor is building a team in your category

- trigger competitive enablement for reps on affected deals

- feed hiring intensity into account scoring models

- create a simple “competitor momentum” dashboard for leadership

How PredictLeads helps you do this without scraping and manual work

Reliable spike detection depends on having structured, historical job data you can query consistently.

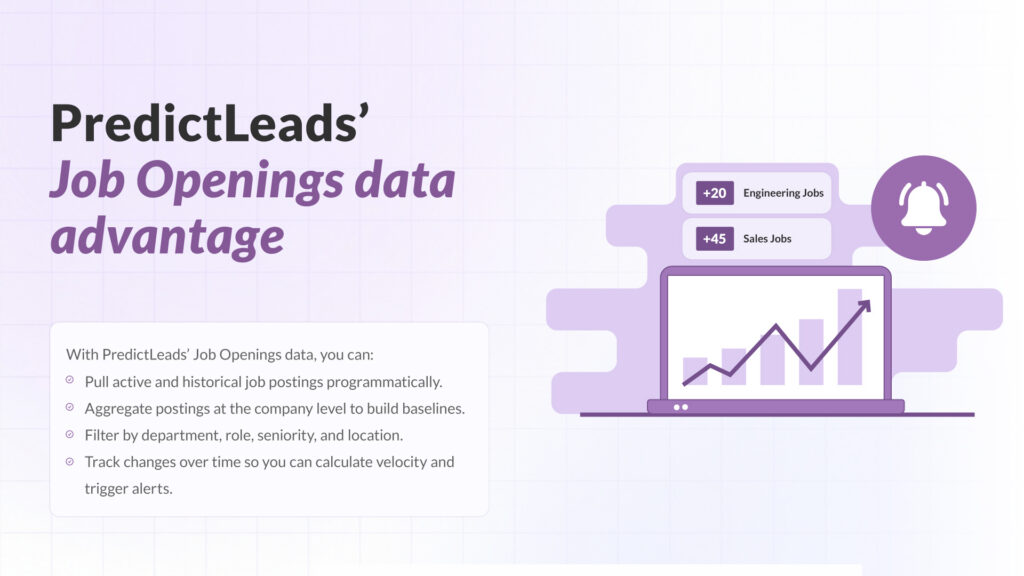

With PredictLeads’ Job Openings dataset, you can:

- pull active and historical job postings programmatically

- aggregate postings at the company level to build baselines

- filter by department, role, seniority, and location to understand what changed

- track changes over time so you can calculate velocity and trigger alerts

Hiring data is also useful when it goes the other way. A sudden drop in postings can hint at budget tightening, a pause in expansion, or a shift in priorities—signals that can matter just as much for account planning and competitive strategy.

If you want higher confidence, you can also combine Job Openings with other PredictLeads datasets (like News, Financing, and Website changes) to validate what the hiring trend likely means.

Common mistakes that make hiring data noisy

Looking at raw counts without a baseline

“40 open roles” doesn’t mean much without knowing whether they typically sit at 10 or 80.

Not splitting by department

Total hiring can stay flat while one team ramps hard. Function-level views are where strategy shows up.

Overreacting to short-lived bursts

A spike that lasts a few days can be reposting, a hiring event, or cleanup on the ATS. Look for sustained movement.

Forgetting to normalize by company size

Twenty new roles is massive for a small startup and barely noticeable for a global enterprise.

Treating hiring as a standalone truth

Hiring is a strong indicator, but you’ll make better calls when you confirm it with funding, product messaging, partnerships, or website changes.

Turn hiring spikes into something your team can use

Competitors leave clues before they make big moves, and hiring is one of the earliest. The teams that benefit aren’t the ones who “watch job boards.” They’re the ones who build baselines, measure velocity, segment by function and location, and route the signal into sales and strategy workflows.

If you’re already tracking competitors, structured job data is one of the easiest ways to make that tracking faster, more consistent, and much more actionable.

About PredictLeads and How We Help

PredictLeads provides the structured company signals that make workflows like the one described in this article possible at scale. Our Job Openings dataset gives you clean, historical, and queryable hiring data so you can build baselines, measure velocity, and detect real hiring spikes across competitors—without manual tracking. Combined with datasets like News, Financing, and Website Changes, we help sales, strategy, and RevOps teams turn early hiring signals into actionable competitive intelligence.