Introduction

Identifying when companies expand into new markets sounds straightforward—until you try to track it reliably at scale. Expansion signals are scattered across press releases, local news, executive interviews, and regulatory filings, often buried in unstructured text. By the time most teams notice them, the opportunity window for sales outreach, partnerships, or competitive response has already narrowed.

For B2B sales, partnerships, and strategy teams, market expansion is one of the strongest early indicators of budget creation and strategic change. This article outlines a practical, repeatable workflow for identifying companies expanding into new markets using structured news events data—so teams can move earlier, prioritize better, and act with confidence.

Why Market Expansion Signals Are Hard to Track Reliably

Fragmented sources and unstructured announcements

Market expansion announcements rarely live in one place. A company might announce a new country launch on its blog, confirm it in a local trade publication, and reference it again in an earnings call. Without structure, these signals are difficult to capture consistently or compare across companies.

Timing challenges for sales, partnerships, and competitive response

Expansion news often surfaces weeks or months after internal decisions are made. Manual monitoring usually means teams discover moves after offices are already open, partners are selected, or competitors have already engaged.

Limitations of manual monitoring and ad-hoc alerts

Google Alerts and manual news tracking do not scale. They generate noise, miss context, and require constant human interpretation, making it difficult to build a reliable and repeatable expansion monitoring process.

Why Market Expansion Signals Matter for B2B Teams

Market entry as a buying, partnership, and hiring trigger

Entering a new market typically requires new vendors, local partners, infrastructure, and talent. This makes expansion one of the highest-intent signals for sales and business development teams.

Relevance for sales prioritization and territory planning

Knowing which companies are expanding into which regions helps sales leaders assign territories, rebalance pipelines, and focus effort where budgets are actively being deployed.

Value for competitive intelligence and GTM strategy

Expansion signals reveal where competitors are investing and which markets are heating up. This insight supports go-to-market planning, pricing decisions, and differentiation strategies.

Importance of early detection versus lagging indicators

Headcount growth or revenue changes usually appear after expansion is already underway. Structured expansion signals provide earlier visibility, enabling proactive rather than reactive action.

Step-by-Step Workflow to Identify Companies Expanding Into New Markets

Step 1: Define what “market expansion” means for your use case

Start by clarifying what qualifies as expansion for your team.

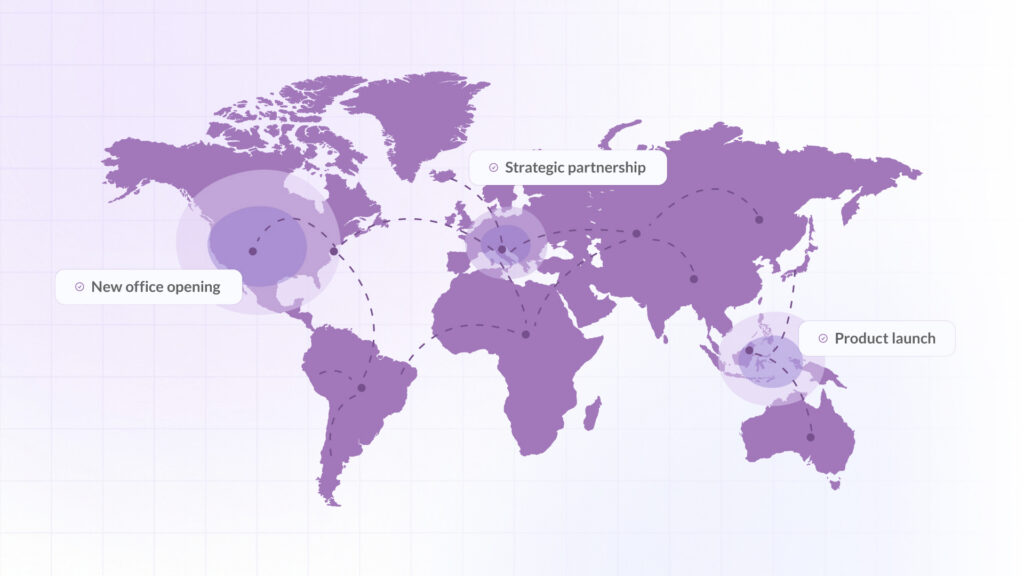

Geographic expansion may include entering new countries, regions, or cities. In other cases, expansion may refer to entering a new industry vertical or customer segment.

It is also important to distinguish between direct expansion (such as opening a local office) and indirect expansion through partners, distributors, subsidiaries, or joint ventures.

Step 2: Identify relevant expansion-related news event categories

Not all expansion signals look the same. Key event types to monitor include:

- Office openings, regional launches, and country-specific announcements indicating operational presence

- Partnerships that signal local market access or distribution agreements

- Acquisitions or joint ventures tied to entering new regions

- Product launches explicitly targeted at new geographic or vertical markets

Using structured event categories makes it easier to capture these signals consistently.

Step 3: Filter companies by expansion events and timeframe

Timing is critical. Filtering by event timestamps allows teams to focus on recent or emerging expansion activity rather than outdated announcements.

It is also important to distinguish between planned expansion (“will enter”) and executed expansion (“has launched” or “opened”). This helps avoid acting too early or too late.

Step 4: Validate expansion signals with supporting context

Strong expansion signals are often supported by secondary indicators:

- Leadership hires for regional roles that confirm execution

- Recent funding rounds or late-stage growth that correlate with multi-market expansion

- Repeat expansion events across multiple regions, suggesting a systematic growth strategy rather than a one-off experiment

Cross-checking context reduces false positives and improves confidence.

Step 5: Prioritize companies based on strategic fit

Not all expansion activity is equally relevant. Prioritization should consider:

- Alignment between the new market and your ideal customer profile or territory

- The speed and scale of the company’s expansion

- Competitive overlap and whitespace opportunities where your solution can differentiate

This step turns raw signals into actionable targets.

Step 6: Operationalize expansion signals across teams

Expansion data delivers value only when it flows into existing workflows:

- Route expansion signals to sales, partnerships, or strategy teams based on relevance

- Feed structured expansion events into CRM systems, alerts, or dashboards

- Monitor post-entry activity such as hiring or local partnerships to guide follow-up actions

Operationalization ensures expansion insights lead directly to action.

How PredictLeads News Events Data Supports This Workflow

Structured categorization of expansion-related company events

PredictLeads classifies company news into structured event categories, making it easier to identify expansion-related signals without manual interpretation.

Company-level event timelines with consistent timestamps

Each event is tied to a company and timestamped, allowing teams to track expansion chronologically and focus on the most recent developments.

Systematic monitoring of expansion activity at scale

Instead of tracking a small set of companies manually, teams can monitor thousands of companies for expansion signals across markets and regions.

Integration-ready signals for downstream workflows

PredictLeads News Events Data is designed to integrate directly with CRMs, data warehouses, and alerting systems, making expansion signals immediately usable by revenue and strategy teams.

Common Mistakes When Tracking Market Expansion

Relying solely on press releases or self-reported claims

Companies often overstate or optimistically frame expansion. Without validation, teams risk acting on incomplete or misleading information.

Confusing intent or planning announcements with actual entry

Statements about future plans do not always translate into execution. Structured event tracking helps distinguish intent from action.

Ignoring secondary signals that confirm execution

Missing supporting indicators such as hiring or partnerships can lead to false positives or poorly timed outreach.

Overlooking smaller or non-obvious market entries

Not all expansions involve headline office openings. Smaller launches, pilots, or partnerships can be equally valuable early indicators.

Conclusion: Turning Market Expansion Signals Into Actionable Growth Inputs

Treat expansion events as time-sensitive operational signals

Market expansion is not just strategic context. It is a trigger for immediate action across sales, partnerships, and competitive teams.

Combine structured news data with internal workflows

When structured expansion data flows directly into existing systems, teams can respond faster and more consistently.

Build repeatable monitoring for long-term advantage

By systematically tracking expansion signals using structured news events data, organizations gain early visibility into growth moves and turn market expansion into a durable competitive advantage rather than a missed opportunity.

About PredictLeads

PredictLeads helps B2B teams identify expansion, hiring, and growth signals at scale using structured company data. By turning unstructured news into integration-ready events, PredictLeads enables earlier, more targeted sales and market intelligence workflows.