Last week, we were proud to sponsor the Data-Driven VC Hackathon, co-organized by Red River West and BivwAk! by BNP Paribas in the heart of Paris 🇫🇷. Over two action-packed days, 80 participants – including developers, data scientists, and VC professionals – came together to tackle one ambitious goal: revolutionizing how venture capitalists make decisions with the power of data. This foundation in Paris will pave the way for the Data-Driven VC Hackathon Paris 2025 event.

Why This Hackathon Matters

The VC industry has long been due for innovation in how data is leveraged. While traditional methods have their place, the hackathon demonstrated that by combining cutting-edge tools, open-source collaboration, and diverse talent, we can push the boundaries of what’s possible. The event offered participants exclusive access to APIs from tier-one data providers. These included PredictLeads, People Data Labs, Similarweb, and Harmonic. This empowered them to bring their most creative ideas to life. Furthermore, the upcoming 2025 hackathon in Paris is expected to build on these innovations in anticipation of the Data-Driven VC Hackathon Paris.

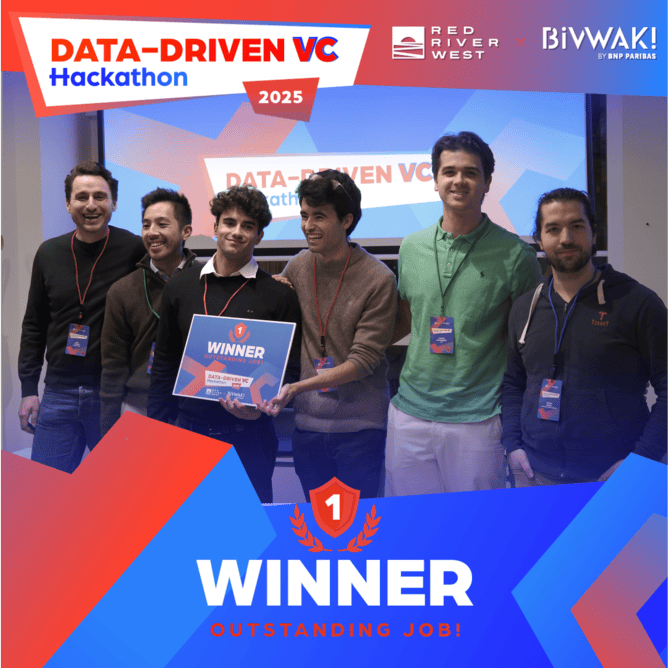

The Winning Project: Pulse

The first-place project, Pulse, blew the jury away with its dynamic, data-driven approach to market segmentation. Built on enriched textual data from sources like PredictLeads, Pulse uses NLP-powered clustering to segment companies into evolving markets. The tool doesn’t just map existing trends but it also visualizes how markets evolve in real-time, offering an extreme level of granularity. This capability has the potential to change how VCs identify opportunities and allocate resources, a key focus for future Data-Driven VC events including those planned for Paris in 2025.

What Made This Event Unique

- Diverse Participation: Teams were composed of coders, data scientists, and VCs from across Europe, creating an ecosystem of expertise and perspectives.

- Real-World Impact: The projects weren’t just ideas but functional prototypes published under an open-source MIT license. This ensures the broader VC community can build on the innovations from the event. 🛜

- VC-Specific Tools: From automated market trend analysis to productivity-enhancing tools for VC workflows, the projects tackled real challenges faced by investors every day. The aim is for Data-Driven VC Hackathon Paris 2025 to further this mission.

PredictLeads’ Role

As a sponsor, PredictLeads provided participants with access to our comprehensive company intelligence datasets, enabling them to work with real-world data. The winners used our insights to identify market shifts, analyze startup activities, and create actionable intelligence. Our mission has always been to make it easier for decision-makers to stay ahead of the curve. This event was a perfect opportunity to showcase how our data can empower innovation, especially looking towards 2025’s Data-Driven VC Hackathon in Paris.

Looking Ahead

The energy at BivwAk! was contagious, and it’s clear that this hackathon is just the beginning. As projects like Pulse continue to evolve, they could become the foundation for new startups. They may transform tools for VCs. The open-source nature of the event ensures that these innovations are accessible to all, fostering collaboration across the industry. This is crucial for future Data-Driven VC events in Paris, especially as we approach 2025.

To the organizers, mentors, and sponsors: thank you for making this event a resounding success. And to the participants: your creativity and dedication were inspiring. We can’t wait to see where this journey leads.

Stay tuned for updates and feel free to explore the winning projects on GitHub. Let’s keep innovating together!