Artificial intelligence is changing the job market, prompting significant shifts in workforce needs across various sectors. By analyzing job postings, investment companies can gain insights into which industries are reducing their hiring for roles likely to be automated. This helps them understand potential revenue impacts and growth opportunities.

Detecting AI Adoption Trends

AI tools are increasingly integrated into business functions, ranging from data analysis to customer service and legal assistance. For example, paralegals, traditionally performing research and document review, are being replaced by AI systems that can quickly and accurately handle these tasks. This trend is highlighted in Nexford University’s article “How Will Artificial Intelligence Affect Jobs 2024-2030,” which underscores the growing use of AI in roles previously performed by humans. Monitoring job postings can reveal decreases in hiring for such roles, indicating a shift towards AI-driven solutions.

Strategic Insights for Investment

Investment companies must stay ahead of market changes to make informed decisions. A decline in job openings for traditional roles, such as customer service representatives or paralegals, in sectors like customer service, sales, and legal services can signal a move towards AI automation. This information is crucial for identifying industries at risk of revenue loss due to a lack of automation foresight, helping investors focus on more promising areas.

For example, companies like Google and Duolingo are already replacing human roles with AI technologies. Google has integrated AI into its customer care and ad sales processes, while Duolingo uses AI for content translation, reducing the need for human contractors.

Economic Impact of AI

The economic implications of AI are substantial. A McKinsey report predicts that AI could add $13 trillion to global economic activity by 2030, primarily through labor substitution and increased innovation. However, this growth comes with job displacement. Monitoring job opening trends helps investment firms gauge which companies and sectors are reducing their workforce due to AI, identifying potential risks and opportunities.

Recent examples include:

- IBM’s layoffs in marketing and communications as they continue their AI charge.

- Google restructuring its finance team as part of an AI shift.

- Dropbox laying off 500 people while pivoting to AI.

- Salesforce hiring 1,800 new employees after mass layoffs, indicating a focus on AI.

- Reports of significant layoffs at Google due to AI impact.

Understanding AI adoption through job postings allows investment companies to anticipate market shifts and focus on high-growth sectors. Sectors such as AI development, advanced manufacturing, and healthcare innovation are likely to attract more investment due to their proactive adoption of AI technologies. This foresight helps investors mitigate risks and capitalize on new growth opportunities.

Additional Data from the ADP National Employment Report

The ADP National Employment Report for June 2024 provides a comprehensive overview of job trends. According to the report, private employers added 150,000 jobs in June, marking a slowdown in job creation for the third straight month. “Job growth has been solid, but not broad-based. Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month,” said Nela Richardson, Chief Economist at ADP (ADP Media Center).

This data underscores the importance of monitoring employment trends to understand the broader economic impact of AI and inform strategic investment decisions.

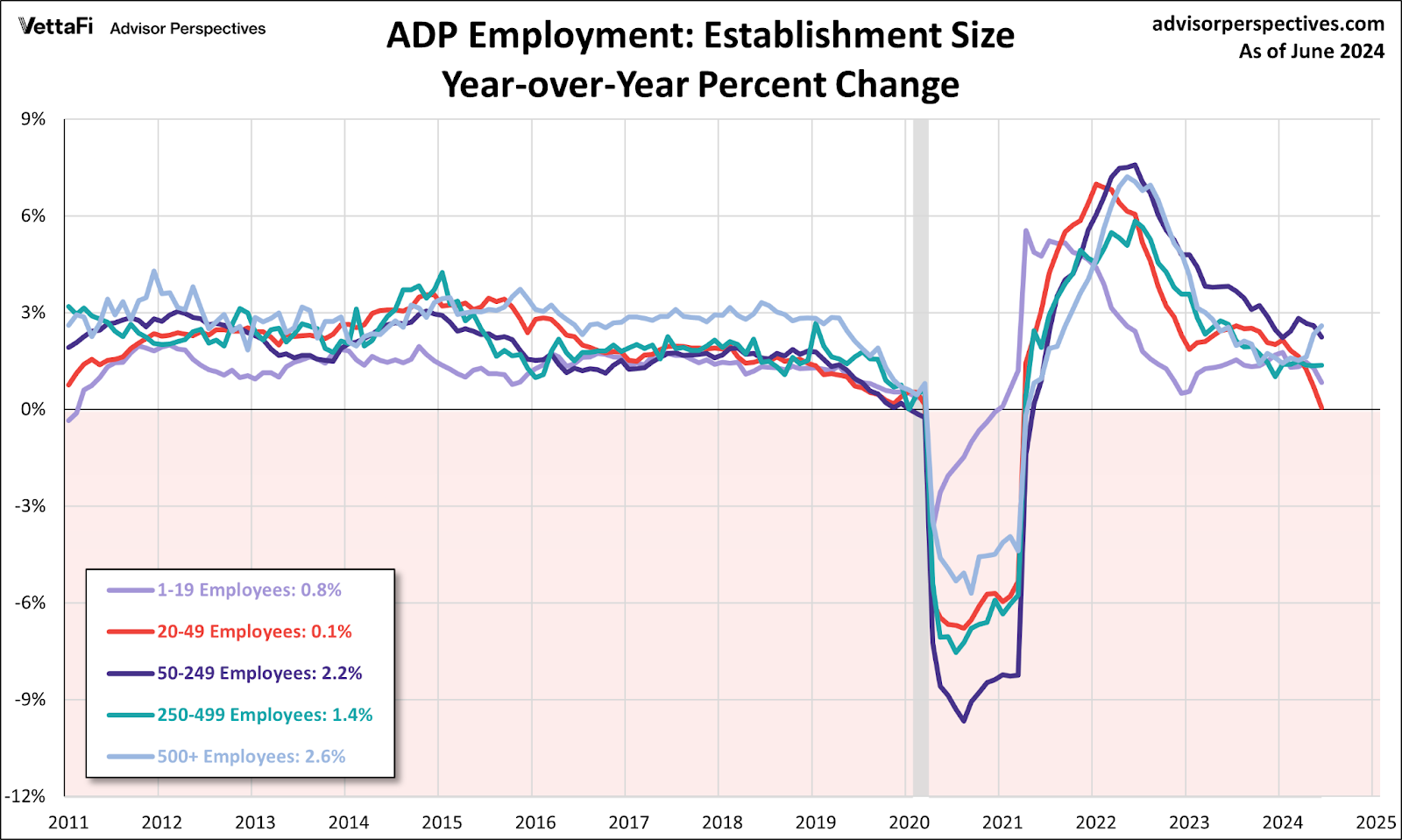

The chart titled “ADP Employment: Establishment Size Year-over-Year Percent Change” tracks the year-over-year percentage change in employment across different establishment sizes from 2011 to 2024.

Here are some key points:

- Trend Analysis: The chart illustrates fluctuations in employment growth across different establishment sizes over the years. A notable drop is observed around 2020, corresponding with the COVID-19 pandemic’s impact on employment. Post-2020, there is a marked recovery, with larger establishments (500+ employees) showing a more robust recovery compared to smaller establishments.

- Recent Trends: As of June 2024, the growth rates have stabilized, though smaller establishments (1-19 employees) show slower growth compared to larger establishments. This indicates that larger companies are recovering and possibly investing more in automation and AI technologies, while smaller businesses are facing more challenges.

This chart helps visualize the employment dynamics and how different-sized businesses have been affected over the years, providing valuable context for understanding the broader economic landscape and the impact of AI on employment.

For more detailed insights and statistics, the full ADP Employment Report is available here.

Conclusion

By analyzing job openings data, investment companies can gain valuable insights into AI adoption trends and their impact on various sectors. This approach helps identify industries reducing traditional roles due to AI, enabling better-informed investment decisions. Utilizing datasets like those from PredictLeads can provide the detailed, real-time insights needed to stay ahead of market shifts, mitigate risks, and seize growth opportunities in an AI-driven economy.

- Job Openings Data: Since 2018, there have been 166 million job openings detected.

- Data Availability: Job openings data is available for 1.6 million websites.

- Recent Trends: Last month, there were 5 million job openings, and over the past year, approximately 50 million job openings were recorded globally.

- Active Job Openings: Currently, there are about 7 million active job openings uncovered by PredictLeads.

These statistics underscore the vast amount of data available to track AI adoption and its effects on the job market, providing investment firms with the necessary tools to make informed decisions.