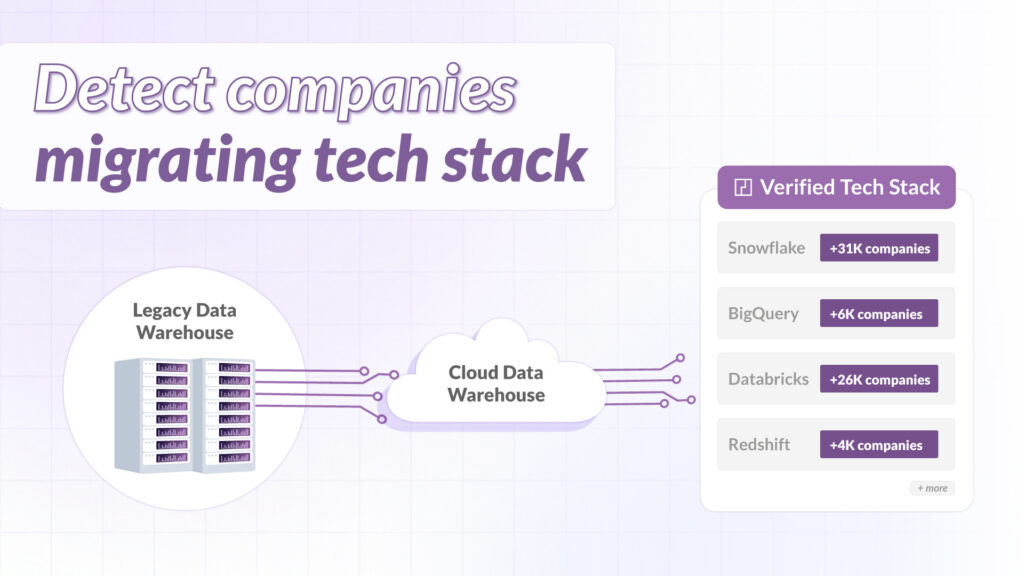

Cloud data warehouse migrations are one of the clearest signs that a company is about to spend money.

When a team moves to Snowflake, BigQuery, Redshift, Azure Synapse, or Databricks, they rarely stop there. New warehouse usually means:

- New ETL or ELT tools

- New BI layer

- Data governance upgrades

- Security reviews

- Consulting support

- Cloud cost optimization

In other words, budget opens up.

The problem is timing and most B2B teams find out about this a bit too late.

This guide explains how to identify companies that are migrating right now using time-based technology detection signals — and how to turn that into a repeatable targeting workflow.

Why Active Cloud Migrations Are Hard to Spot

Companies don’t announce:

“Today we started migrating our warehouse.”

Migration happens quietly.

Engineers spin up environments.

Pipelines run in parallel.

Legacy systems stay live during transition.

By the time a blog post or press release appears, the migration is often done.

Surface Signals Are Too Slow

Common approaches don’t work well:

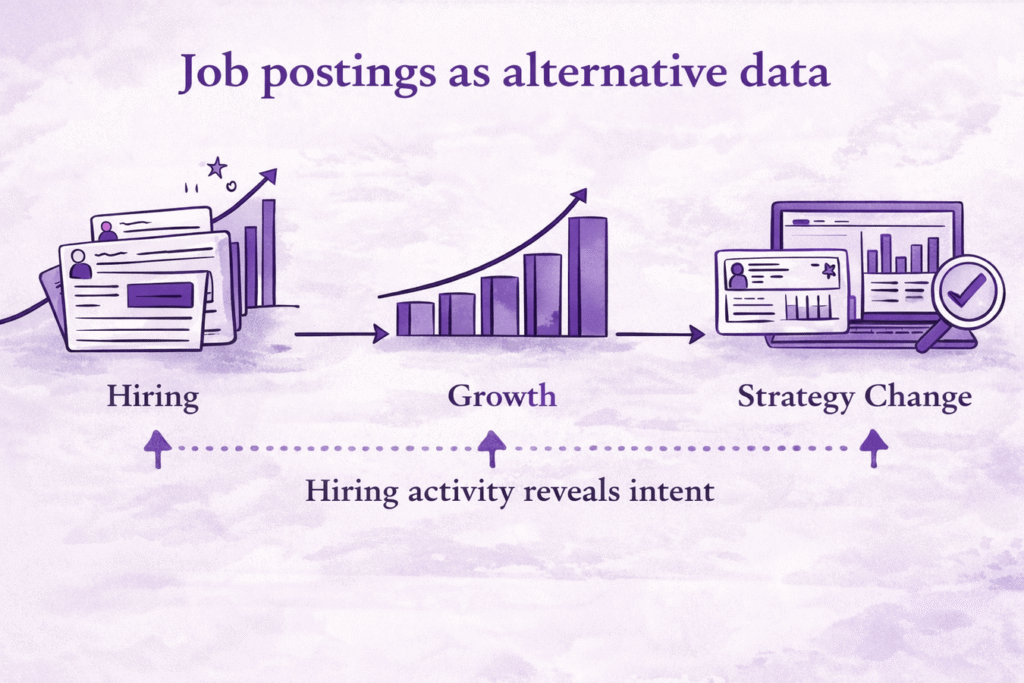

- Job postings show up mid-project

- Press releases come after contracts are signed

- Sales discovery depends on someone replying

All of these identify accounts after vendor decisions are already in motion.

If you want leverage, you need earlier evidence.

What Early Migration Signals Actually Look Like

The earliest reliable signal is simple:

A cloud data warehouse appears in a company’s tech stack for the first time.

Not three years ago.

Not “currently detected.”

But newly detected.

That timestamp matters because migration is not an event. It’s a timeline.

Why Cloud Warehouse Migration Signals Matter Commercially

Warehouse migrations don’t happen in isolation.

When a company moves from on-prem databases to Snowflake, they often re-evaluate:

- ETL (Fivetran, Airbyte, Stitch)

- BI (Looker, Power BI, Tableau)

- Reverse ETL

- Data observability

- Governance tools

This creates a 3–6 month window where architecture decisions are still flexible.

If you engage during that window, you influence the stack.

If you engage after it closes, you compete on price.

That’s the difference.

Step-by-Step: How to Find Companies Migrating to Cloud Data Warehouses

Here’s the practical workflow.

Step 1: Define What “Migration” Means for You

Start by defining scope clearly.

Are you looking for:

- Any new Snowflake detection?

- Companies switching from Oracle or Teradata to cloud?

- BigQuery adoption among mid-market SaaS?

- Databricks expansion inside enterprise accounts?

Without a defined scope, you’ll generate noise.

Step 2: Identify First-Time Detections

Filter for companies where a warehouse platform appears for the first time.

Example logic:

- Technology = Snowflake

- first_seen_at exists

- No prior Snowflake detection historically

This removes long-time users and isolates change events.

Step 3: Apply a Recency Window

Now narrow by time.

Filter first_seen_at within:

- Last 30 days (aggressive targeting)

- Last 60 days (balanced)

- Last 90 days (broader coverage)

Why?

Because a warehouse first detected 2 years ago is not a migration signal anymore. It’s just part of the stack.

Recency separates momentum from history.

Step 4: Check for Parallel or Legacy Systems

Migration often means coexistence.

If you detect:

- Snowflake + Oracle

- BigQuery + on-prem SQL Server

- Databricks + Hadoop

That overlap suggests transition.

If legacy tech disappears over time (based on last_seen_at), you likely caught a replacement cycle.

That’s stronger than a single detection.

Step 5: Segment by ICP

Now layer firmographics:

- Company size

- Revenue

- Industry

- Geography

- Funding stage

You can also segment by data maturity:

- Number of data tools detected

- Presence of ETL + BI + warehouse

- Cloud provider preference

This prevents wasting time on companies that don’t fit your model.

Step 6: Prioritize Based on Stack Complexity

Not all migrations are equal.

High-priority accounts often show:

- Recent warehouse first_seen_at

- Multiple data tools

- Legacy tech still present

- Active hiring for data roles

That combination usually means real architectural change.

How Technology Detection Data Makes This Possible

You cannot do this manually.

Technology detection datasets track which tools are used by which companies — and when those tools were first and last seen.

Two fields matter most:

first_seen_atlast_seen_at

If Snowflake first appears 45 days ago and is still detected, that’s likely active rollout.

If Teradata detection disappears shortly after, that suggests replacement.

This timeline view turns static tech stacks into motion data.

That’s the difference between “uses Snowflake” and “just started using Snowflake.”

Multi-Signal Analysis Reduces False Positives

One detection can mean many things.

But multiple coordinated detections strengthen the signal.

For example:

- New Snowflake detection

- New Fivetran detection

- BigQuery API endpoints detected

- Tableau usage declining

That cluster suggests intentional transformation.

Single-point snapshots miss this.

Longitudinal tech data reveals it.

Common Mistakes Teams Make

Mistake 1: Treating “Uses Snowflake” as Intent

Usage does not equal migration.

Without first_seen_at analysis, you’re targeting stable accounts.

Mistake 2: Ignoring Time

Migration is a process.

Static lists don’t capture direction.

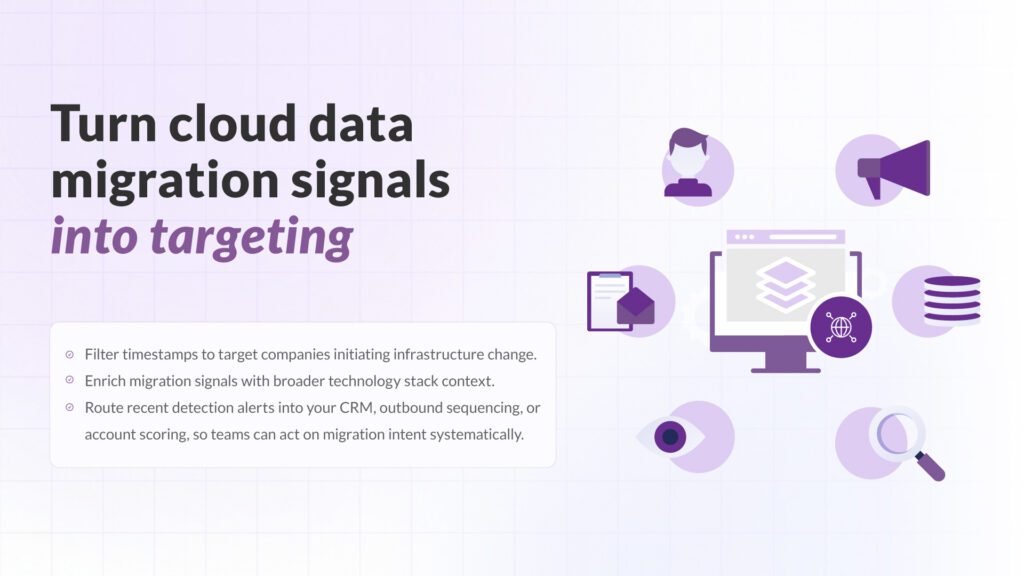

Mistake 3: Not Connecting Signals to GTM

If migration data sits in a spreadsheet, it’s useless.

It should trigger:

- CRM enrichment

- Outbound sequences

- Account scoring

- Partner alerts

Speed matters. A 90-day window closes fast.

Turning Migration Signals Into Revenue

Cloud warehouse migrations create rare moments of openness.

During that window, teams are:

- Re-architecting

- Reviewing vendors

- Allocating budget

- Rewriting workflows

If you align outreach to that moment, relevance increases immediately.

Instead of:

“Just checking if this is relevant…”

You can say:

“Saw you recently adopted Snowflake. We help teams optimize ELT pipelines during warehouse transitions.”

Now you’re turing a cold pitch into context.

Final Thought and a Quick Word About PredictLeads

PredictLeads helps B2B teams identify companies migrating to cloud data warehouses by tracking technology detections over time.

Instead of static tech stack snapshots, you get access to:

- First-time detections of Snowflake, BigQuery, Redshift, Databricks, and more

first_seen_atandlast_seen_attimestamps- Company-level technology change signals

- API access for automated targeting

- And much much more

By monitoring when a cloud data warehouse is first detected, you can identify companies actively migrating and not those who adopted years ago.

If you want to find companies moving to Snowflake or BigQuery before the rest of the market notices, PredictLeads provides the underlying technology detection data to make that possible.