Most automation tools are only as good as the data you feed them. PredictLeads focuses on providing that missing piece – clean, structured company data that can actually make automations useful. The integration with AI automation tools offered by PredictLeads allows you to surface things like job openings, tech stacks, funding events, and company news, so your workflows can react to what’s happening in real-time. Whether you’re using APIs or no-code integrations, PredictLeads helps you gain valuable insights.

You can connect PredictLeads to your favorite AI agents and automation tools such as Activepieces, n8n, Make.com, Zapier, and Bardeen.ai to make your workflows actually smart, not just automated.

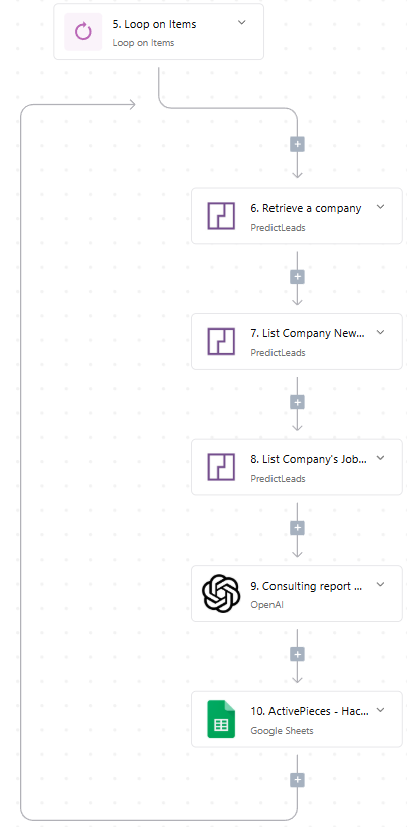

1. Activepieces

If you haven’t tried Activepieces, think of it as open-source Zapier that’s simple and powerful.

The new PredictLeads integration lets you pull company insights and trigger actions across hundreds of apps. You can:

- Enrich CRM records when a new company domain shows up.

- Post in Slack when one of your tracked companies adds several new job openings.

- Notify your sales team when PredictLeads detects a new funding event using PredictLeads integration with AI automation tools.

Available PredictLeads actions:

- List Companies

- List Job Openings

- Get Company by Domain

- Retrieve Companies by Technology

- Get News Event

- List Company News Events

- List Technologies by Domain

- List Connections

- Make Custom API Calls

You can start experimenting with it directly on Activepieces. No code, no setup pain.

2. n8n

n8n is great when you want more logic and control in your automations.

This tool allows for PredictLeads integration with AI automation features to blend seamlessly with CRMs, Slack, Google Sheets, or your custom systems.

Example ideas:

- Automatically find companies hiring for “AI Engineers” and send them to your CRM.

- Get alerts when portfolio startups start scaling their teams.

- Filter PredictLeads data to show only companies that match your target tech stack.

n8n is for those who like to see the inner workings of their automation instead of just hitting “run.”

3. Make.com

Make.com (formerly Integromat) is perfect if you prefer visual workflows.

By connecting PredictLeads, you can:

- Pull new job openings, check if they fit your ICP, and push them into your CRM.

- Watch for technology changes like new marketing tools detected on company websites.

- Create a live dashboard that tracks companies hiring for data roles in your target region through PredictLeads integration with AI automation tools.

Make.com turns PredictLeads data into visual, flowing automations that are easy to understand.

4. Zapier

Zapier might be the old classic, but it’s still the easiest starting point for most.

You can set up simple PredictLeads automations such as:

- Adding new job openings to Google Sheets.

- Sending outbound leads to Notion when they meet specific filters.

- Getting Slack notifications when a company is mentioned in PredictLeads News Events with the advantages of PredictLeads integration with AI automation tools.

Zapier works great when you want to get started quickly and don’t need complex logic.

5. Bardeen.ai

Bardeen.ai is an AI agent that automates your browser.

Combine it with PredictLeads data and you can:

- Scrape company lists from the web and enrich them instantly.

- Build prospect lists based on who’s hiring and send them into your CRM.

- Write personalized outreach messages using PredictLeads company data integrated with AI automation tools.

It’s the easiest way to use PredictLeads data directly from your browser while staying in flow.

TL;DR

PredictLeads gives you the data.

Activepieces, n8n, Make, Zapier, and Bardeen give you the automation.

Put them together and you can:

- Build lead lists automatically.

- Track hiring trends across your ICP.

- Get alerts before competitors do.

- Automate the parts of prospecting that nobody enjoys.

If you want to test it out, check the PredictLeads integration on Activepieces or dive into the full API docs at docs.predictleads.com/v3