Estimated reading time: 4 minutes

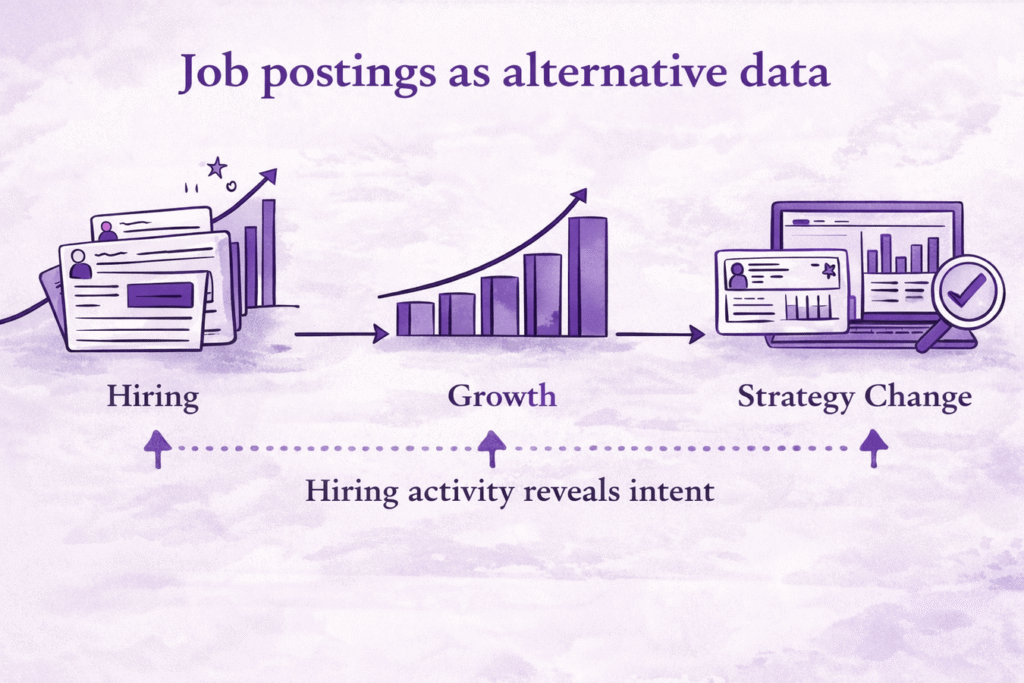

Most company data explains what a business is, but the sad reality is that very little explains what it is changing.

Revenue ranges, headcount bands, and industry labels stay the same for long periods of time. Hiring activity does not. When a company opens roles, it signals budget approval, internal priorities, and upcoming operational work.

This is why job postings have become one of the most reliable sources of alternative data.

What a Jobs Dataset actually represents

Jobs Dataset explained

A Jobs Dataset collects job postings published by companies and structures them into data that can be analyzed over time.

The goal is not to help candidates find roles.

The goal is to observe company behavior.

Each posting reflects a decision that already passed internal approval: someone agreed to spend money and add capacity.

What hiring activity tells you

Job postings indicate:

- where budget is being allocated

- which teams are growing

- what problems the company is trying to solve

- how close the company is to execution

Viewed in isolation, a job posting is just a role. Viewed across time and across departments, it becomes a signal.

PredictLeads tracks hiring activity across millions of companies, allowing both current monitoring and historical comparison.

Why hiring data beats company profiles

Profiles describe. Hiring shows movement.

Firmographic data answers basic questions:

- size

- industry

- location

Hiring data answers different ones:

- which team is expanding

- whether growth is steady or temporary

- how priorities are shifting

A company can fit an ICP definition for years without buying anything. Hiring introduces timing.

Timing changes outcomes

A company hiring RevOps, data engineering, or security roles is in a different position than one that is not hiring at all.

That difference affects:

- outreach relevance

- deal likelihood

- research accuracy

Jobs data helps decide when to engage, not just who to list.

Hiring as intent you can verify

Interest versus commitment

Some signals show curiosity. Others show action.

Reading content or searching keywords costs nothing. Opening a role costs money.

Examples:

- Sales Ops roles point to go-to-market investment

- Data engineering roles point to internal data work

- DevOps roles point to scaling infrastructure

- Security roles point to compliance pressure

Each role maps to a real internal need. That need already has funding behind it.

Why Jobs data works as a predictive signal

The value is in patterns, not posts

Single job postings are noisy. Patterns are not.

A strong Jobs Dataset allows analysis of:

- how often roles are opened

- which departments grow together

- whether hiring continues or stops

- where teams are being built

These patterns help distinguish:

- growth from maintenance

- short experiments from long-term plans

- readiness to buy from internal build phases

That is why hiring data supports scoring and prioritization instead of simple enrichment.

Practical use cases for a Jobs Dataset

Sales and outbound

Jobs data helps sales teams:

- focus on companies with active budget decisions

- align outreach with team needs

- avoid accounts showing no momentum

Outreach becomes event-driven instead of list-driven.

Account scoring

Hiring volume, role mix, and recency can be combined to:

- surface expansion signals early

- deprioritize inactive accounts

- support objective account ranking

Market and ICP analysis

Jobs data shows:

- which roles appear in which industries

- how functions evolve over time

- whether assumptions about buyers hold up in practice

This is useful for strategy, not just targeting.

Investment and research

Hiring trends often move before financial metrics.

Jobs data helps researchers:

- spot early-stage growth

- compare companies with similar profiles

- monitor changes without relying on announcements

Why historical hiring data matters

Looking at hiring once tells you very little.

What matters is:

- consistency

- direction

- change

Companies that hire steadily behave differently from those that hire in bursts. Declines often show up in hiring before they show up elsewhere.

PredictLeads provides historical Jobs data so trends can be measured, not guessed.

How the PredictLeads Jobs Dataset is designed

The PredictLeads Jobs Dataset is:

- structured and machine-readable

- accessible through API and exports

- built for automation and analysis

- independent of any proprietary workflow

It fits into existing data, GTM, and research systems without forcing process changes.

Conclusion

Job postings are not just recruitment noise; they are clear economic signals.

A Jobs Dataset shows:

- where money is being spent

- which teams are expanding

- when companies are preparing for change

For alternative data use cases, hiring activity remains one of the earliest and most reliable indicators of company intent.

About PredictLeads

PredictLeads is a data company that tracks how companies change over time by observing real actions such as hiring, technology adoption, and company events across 100 million businesses worldwide.

It provides this data as a flexible, API-first layer that teams can use inside their existing sales, GTM, research, and investment workflows to understand timing, intent, and momentum.